The Pros and Cons of Filing for Bankruptcy in the UK

If you’re facing mounting debts, are struggling to pay bills, or are fed up with creditors hounding you for cash, then filing bankruptcy could be the way out you’re looking for.

Filing bankruptcy can give you the opportunity for a fresh financial start, but it’s not as simple or as easy as just wiping the slate clean. Filing bankruptcy is a serious legal process to undertake and, given the potential for long-lasting repercussions for you, your business, and your family, it’s not a process that should be ever entered into lightly.

If you’re facing financial difficulties, the experts at Irwin Insolvency are here to explain the pros and cons of filing for bankruptcy.

What Is Bankruptcy?

If you’re no longer able to pay your debts and are facing serious financial trouble, it’s possible for you to declare yourself bankrupt. Filing bankruptcy is a legal procedure overseen by the UK’s Insolvency Service, and it’s a process that can only be undertaken by individuals – not businesses – who have become insolvent.

Bankruptcy can wipe your major debts clear, effectively providing you with a fresh, financial start at the end of your bankruptcy period. For most individuals, this initial period of bankruptcy only lasts 12 months, but your credit score can be tarnished for many more years to come. There’s no minimum amount of debt that needs to be owed before an individual can declare bankruptcy, but they must be able to pay the £680 filing bankruptcy fee.

While it’s common for individuals to personally declare bankruptcy, bankruptcy can also be forced upon an individual through a court order – a situation that can arise if a creditor has had enough and wishes to recoup the money owed to them from a debtor. This form of involuntary bankruptcy can occur if an individual owes £5,000 or more to creditors.

What Are the Pros and Cons of Bankruptcies in the UK?

Filing bankruptcy is a formal legal procedure that must go through a court of law and, as such, it’s highly recommended that you speak to a professional insolvency practitioner before filing. In fact, financial experts often see filing bankruptcy as a last resort; there are many more insolvency measures that can be taken before it gets to this stage.

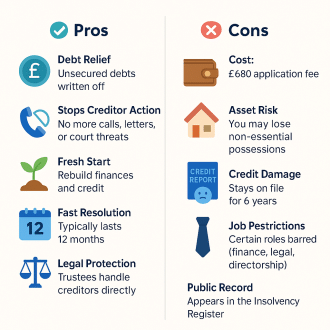

If you are seriously considering filing bankruptcy, it’s important to weigh up the pros and cons, to see if the advantages will outweigh the disadvantages. Let’s take a look at the pros and cons of bankruptcies UK in more detail.

The Pros of Filing Bankruptcy

The biggest advantage of filing bankruptcy is having your major debts wiped clean after a 12-month bankruptcy period. You don’t always lose your home or even your car, and for many individuals filing bankruptcy can be the best way to start over.

Here are the major pros of filing bankruptcy:

- You are given a fresh financial start after the 12-month bankruptcy period ends.

- Once you’ve been declared bankrupt, an insolvency practitioner takes over your finances and administrates those finances throughout the bankruptcy period.

- Legally, creditors can no longer chase or harass you for payments.

- The pressure is off, and you have time to think, plan, and prepare for the future.

- Your major debts are consolidated, and new payment terms can be agreed upon with your creditors.

- After the 12-month bankruptcy period, these major debts can be written off, even if unpaid.

- If you are employed or have any other source of income, you’re allowed to keep enough money to live off each month.

- If personal assets – such as your family home or car – are owned by your partner, these cannot be taken away to pay off debts.

- If you are employed and need your car to drive to work, you’ll often be allowed to keep your primary vehicle.

- Individuals can seek employment or be self-employed whilst bankrupt.

- Once the 12-month bankruptcy period has ended, you can start new businesses and seek new lines of credit.

- If you’re subject to an income payment order (whereby a percentage of your income is taken to pay off your debts), this can last no longer than three years.

- After six years, bankruptcy is struck from your credit record.

The Cons of Filing Bankruptcy

While bankruptcy initially sounds like an easy way to escape responsibility for large debts, it’s never that simple. Not all debts are covered by bankruptcy, and filing bankruptcy will make it exceptionally difficult for you to secure any line of credit in the future, even after bankruptcy is struck from your credit file.

You may lose all of your high-value assets, your business, and your reputation will be negatively affected for years to come. Your family and friends could suffer through the long process, too.

Here are the major cons of filing bankruptcy:

- For 12 months, you’re legally classed as an undischarged bankrupt.

- For 12 months, it’s impossible to secure any line of credit over £500.

- You lose all control over your finances. All of your bank accounts are closed, and the official receiver controls all of your finances for the next 12 months (this is the official name of the insolvency practitioner in charge of your case).

- Personal assets – including any high-value items such as cars and property owned in your name – can be seized and sold to pay off your debts.

- If you have a rental agreement, the landlord is legally entitled to end your tenancy agreement.

- Many personal debts, including student loans, child support payments, parking fines, and more cannot be wiped out by bankruptcy.

- If you’re employed or have any other forms of income, the courts can issue an income payment order that takes away a certain percentage of your income each month to pay your debts.

- Income payment orders last for a minimum of 12 months and, in some cases, can last for three years.

- Although the bankruptcy period ends after 12 months, it remains on your financial record for a minimum of six years after this. After these six years, you are still legally obliged to reply truthfully if a creditor asks if you’ve ever declared bankruptcy.

- You can legally apply for credit again after 12 months, but you will find that securing credit isn’t easy. You’ll have to undergo more thorough vetting for loans and be subject to much stricter payment terms and much higher interest rates than pre-bankruptcy.

- If you own a business, the business can be taken over or sold to pay off your debts. This can result in members of staff losing their jobs, while your standing and reputation in the business community may be compromised.

- Bankruptcy is public knowledge, and this can affect your reputation in the wider community.

- If you work as a lawyer, Member of Parliament, or trustee of a charity – or in many other positions of importance – you can be removed from the position.

Read more on declaring bankruptcy in our guide

Should You File for Bankruptcy in the UK?

Before filing for bankruptcy, it’s important to consider all of the pros and cons of doing so. Everyone has their own, unique financial and personal situation to consider, and ultimately this isn’t a decision to be made lightly or without the expert assistance of an experienced insolvency practitioner.

There’s no minimum amount of debt needed to declare bankruptcy – your debts can be minor, or equally, they can be enormous. However, you should only file for bankruptcy if you have large debts that have become unmanageable and unpayable. If you only have small levels of debt, there are many more ways to remove yourself from a position of insolvency, before having to declare yourself bankrupt.

If you have large assets that could potentially be lost – particularly a family home or vehicle – then declaring bankruptcy can put these high-value items at risk, and you should consider alternatives to bankruptcy. Business owners need to understand that their employees’ livelihoods can be put at risk by declaring bankruptcy, while anyone in a position of trust needs to think twice.

So, if filing for bankruptcy isn’t suitable for you, what are the other options on the negotiation table? Common alternatives to bankruptcy include:

-

- Individual voluntary arrangements (IVA)

- Debt management plans

- Debt consolidation plans

- Debt Relief Order (DRO)

- Administration orders

Let’s take a look at these alternatives in more detail.

Individual Voluntary Arrangements (IVA)

An individual voluntary arrangement (IVA) is one of the best ways to avoid bankruptcy. An IVA is an agreement between the debtor and the creditor – arranged through a licensed insolvency practitioner – that establishes a way for debts to be cleared.

An IVA can result in reduced payments, lowered interest rates, or the consolidation of debts. Reorganisation can help to streamline the amount of money that needs to be paid, while an IVA may also result in some debts being wiped out entirely.

Debt Consolidation Plans

Debt consolidation plans are one of the easiest ways to avoid filing bankruptcy, and they can help if you’re in either large or small amounts of debt. A debt consolidation plan provides an individual with a way to consolidate all of their existing debts into one, much more manageable debt.

The individual will be able to take a new loan that can be used to pay off the consolidated debt. This new loan will result in much-reduced interest rates and more favourable payment terms, making it an attractive option that’s often a very viable alternative to filing bankruptcy.

Administration Order

An administration order is another way to avoid filing bankruptcy, but only if you owe less than £5,000. An administration order is a court order that reorganises your debts and allows you to pay back a set amount each month, for a set period.

An administration order is an attractive option for anyone with low levels of debt, as once the order has been issued, your creditors can no longer chase you for payment. This gives you much more time and space to reorganise your finances, and can often result in reduced interest rates and much more favourable repayment terms.

Who Should File for Bankruptcy?

Anyone with low levels of debt that could be managed in other ways or anyone with high-value assets they can’t afford to lose should consider these other avenues before filing bankruptcy. If you are in a position of trust, you’ll want to reconsider filing bankruptcy too, particularly if you have a reputation within the community to uphold.

However, bankruptcy could be the best option if you meet any of the following criteria:

- You have few assets to lose, or you can afford to lose your major assets.

- You have huge debts that can be wiped out by filing bankruptcy.

- You don’t hold a position of trust within the community.

- You don’t have or can afford to lose your business.

- All other efforts to pay your debts have failed.

Filing bankruptcy should always be a last resort. However, if you have exceedingly large debts that could be cleared by bankruptcy, then this advantage on its own often outweighs the cons. There’s also no real limit on the number of times you can declare bankruptcy in your lifetime, so if you have few assets and little to lose, filing bankruptcy can be an effective way to gain a new start and new opportunities in life, safe in the knowledge that you can file for bankruptcy again in the future if needed.

Ultimately, whether or not the pros of filing for bankruptcy outweigh the cons comes down to your financial scenario. Everyone is in a different personal and financial situation, and we highly recommend consulting an experienced insolvency practitioner before making any decisions.

Contact Irwin Insolvency for More Information on Filing Bankruptcy in the UK

Filing bankruptcy can be the best way for individuals to have a financial fresh start, but many other insolvency measures should always be considered first.

Bankruptcy can have severe, long-term consequences, and it’s recommended to seek out the advice of an experienced insolvency practitioner to seriously consider the pros and cons, first.

To find out more about filing bankruptcy, contact Irwin Insolvency today for your free consultation.

Get in Touch

With over 25 years of experience, helping people just like you, we are committed to providing you with all the help and advice you need during these challenging times. Simply give us a call, drop us an email or fill in the form to find out how we can help you.

Our Office

Irwin & Company,

Station House,

Midland Drive,

Sutton Coldfield,

West Midlands B72 1TU

Call us

0800 254 5122

Email us

[javascript protected email address]

Fill in the form below and a member of our expert team will be in touch to discuss how we can help you.

"*" indicates required fields